Acquisition project | EAM360

Exploring the product - an initial summary

What is this product, EAM360, all about?

As per search results across the web, social media and review platforms, EAM360 is defined by the creators broadly as -

Suite of role-based mobile apps for

IBM Maximo.

Some information from sources across the internet:

This can be broken down part-by-part.

What is IBM Maximo?

IBM Maximo, now also known as IBM's Maximo Application Suite, is a software with a suit of applications that help small-to-large scale, asset-intensive enterprises handle their assets (infrastructure) by acting as an efficient CMMS system. IBM Maximo's goal itself is to help users achieve fully digitized CMMS and efficient EAM through its various applications.

Going back to EAM360's definition again - "EAM360 is a role-based mobile app suite for IBM Maximo."

Decoding the product description

EAM360 is in simple terms, a "mobile skin", a second layer over IBM Maximo. Instead of interacting with IBM Maximo directly , users of this software can perform all their transactions through the mobile app conveniently.

A deep dive into the user base of EAM360

This section answers all sorts of question such as:

- Who is this product targeted at?

- What are the ICP's we can define?

- Why would they need this product at all?

- Are they problem aware, solution aware, and solution receptive?

- What competing products do they explore?

- How does EAM360 rank amongst competitors?

Broad segments : target audience of EAM360

Target verticals are asset heavy enterprises employing technician counts between 100-1000 heads.

Category | Estimates |

|---|---|

Industries |

|

Target regions (top 3) |

|

Annual organization turnovers | ~$200Mn to $1Bn |

Overall budget allocation for IBM Maximo | $1.5Mn- $2.5Mn/year |

Life time of IBM Maximo usage before reconsideration | 5-10 years |

Overall budget allocation for EAM360 | ~ $500k - $700k + yearly support and other spending |

Some key observations about the target organizations:

- Many target groups are either government bodies or government-supported. This results in a longer sales cycle, higher levels of competition with other vendors through open RFP's and the need for official authorization to onboard a mobile application.

- With private organizations, decision making depends largely on acquiescence of individual team verticals, sometimes with unionized technicians, crafters and ground users. User adoption is a major buy-in that is needed to make the purchase decision.

Sample target organizations with purchase and usage power:

Company type | Main service | Service offering | Annual turnover |

|---|---|---|---|

A city-wide utilities company in USA. | Civilian occupants in the district | Electricity and water supply | $450Mn |

Large-scale pharmaceutical manufacturer | Medical distributor services, govt entities, healthcare orgs | Vaccines, chemicals and medical drugs | $1Bn+ |

Picking out ICP's and picking through their lives

Picking out some customers to find investigative answers:

- Are you a user of IBM Maximo?

- What is your job role?

- How many years of experience do you have?

- What are some of the major goals you are working towards?

- What are some of the main issues you face in your day-to-day jobs?

- Have you ever considered mobility for Maximo?

- What are the top uses you're looking for from a mobile app?

- Can you think of any downsides of a mobile app?

- Who are the major people in your company you need buy-in from?

- Have you heard of EAM360 before?

- What are other mobile Maximo apps you have considered?

Based on evaluating the personalities, needs and behaviours of various prospects and customers, here are 2 customer profiles that have ideal intent and purchasing power.

Name | Designation | Company description | Industry | Roles and responsibilities | Top apps used | Target product users | Total# of prospective app users | Used mobile solution before? | Other product considerations | Growth |

|---|---|---|---|---|---|---|---|---|---|---|

John | Head of Maintenance and Engineering | Government body - public utilities provider in North America to a district of ~1mil people | Utilities | Responsible for overseeing end-to-end maintenance management, planning and supervising maintenance managers and schedules. | IBM Maximo, ERP, SAP, Documentum | Technicians and storekeepers | ~250 technicians | No | IBM Maximo mobile | Saturated |

Kathy | Maximo Solutions Architect | Life sciences organization working in biotechnology research with an extensive laboratory | Life sciences | Responsible for strategizing and handling organization's Maximo practice, investments, and advising the organization on the best course forward. | IBM Maximo, ERP, SAP, internal compliance tools | Crafters and supervisors | ~100 crafters | Yes. Tried and failed with IBM Maximo app (competitor product) | All competitors except IBM Maxim mobile | Growing |

ICP Persona 1: John, Head of Maintenance Engineering

Let's pick up John's example.

Is John an end user? Occasional yes.

Is John a key decision maker who takes the product from the market to the end user? Yes.

Hence, he is a key ICP persona that all efforts are to be directed at.

Personal information about John

Demographic | Detail |

|---|---|

Age | 45 |

Gender | Male |

Nationality | American |

Average income per annum | $150,000 |

Influencers:

- Peers and colleagues of other departments

- Awareness due to mobility for Maximo vendors via events and reach outs

Blockers:

- Finance teams due to budget restrictions

- Internal decision makers who are opposed to spending on a mobile product

ICP Persona 1: Kathy, Maximo Solutions Architect

Is Kathy an end user? No.

Is Kathy a key decision maker who takes the product from the market to the end user? Yes.

Personal information about Kathy

Demographic | Detail |

|---|---|

Age | 47 |

Gender | Female |

Nationality | American |

Average income per annum | $100,000 |

Influencers:

- Ground technicians who directly work with the previous product

- Maximo team that is unable to resolve support queries for technicians

Blockers:

- IBM itself encouraging a mobile app marketed as "free" with its MAS solution

- Effort for change management and exploration of a new product

Product/Category/Market of EAM360

A core factor to remember about prospects of EAM360 - they are not always solution aware. Broadly, the prospects can be divided into 2 categories:

- Specific seekers of mobile apps for Maximo

- Problem-aware audience who are looking for a solution to their existing challenges who have not considered mobility so far.

Keyword research on search engines

Organic keyword research, coupled with search intent, highlights top relevant search terms (including long tail keywords). This list is created via understanding user intent, mind-mapping and research + feedback from ICP's.

- IBM Maximo mobile - Informational/ Transactional

- Maximo mobile app - Informational/Transactional

- IBM Maximo - Commercial ( Max keyword volume)

- Maximo Application Suite - Informational/ Commercial

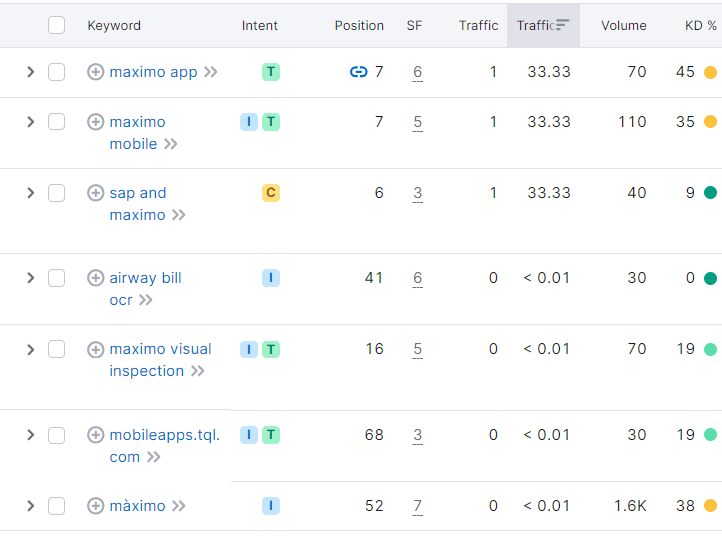

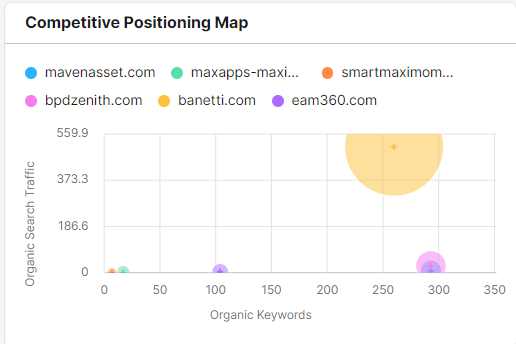

Top ranking keywords for EAM360's website

Inference:

The existing website content largely matches with the intent of user search terms. "Maximo app" and "Maximo mobile", which are top ranking keywords based on intent to capture audience both have EAM360 in the top 10 search terms.

The keywords related to "Maximo Application Suite" aka MAS also find their place within EAM360's website in the blogs section, seeing as MAS is largely searched within information and commercial contexts.

Top recommendation for EAM360's website:

- Investigation of industry-specific search terms such as "asset management for utilities" and "facilities Maximo asset management" - to approach the user base from an industry-specific perspective.

- Work on building content muscle around IBM Maximo and MAS specifically - to capture those with intent to understand the base product the app works on.

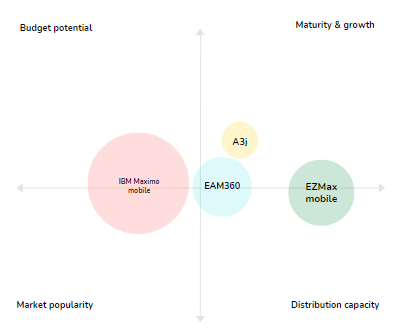

Understanding competing products

What are some of the top competing products which are available in the market? What options do prospective buyers have to pick from?

The market is exclusively dominated by top 4-5 competitors that includes EAM360. There are not many other major products in this space that can capture market and serve customer base.

An important factor is that IBM itself has a mobile product called IBM Maximo mobile app that goes along with IBM Maximo, the base software. This is an automatic trust factor inducer, as the product is positioned to be a part of the Maximo Application Suite by the OEM, that too for "free".

From review sites such as Capterra, G2 as well as marketplaces such as RedHat marketplace, here are the top 3 competitors of EAM360.

Comparison factor | EAM360 mobile | EZMax Mobile | IBM Maximo mobile | A3J mobile app |

|---|---|---|---|---|

Price | Medium | Medium | Low | Medium |

Implementation time | Low | Low | Medium | Low |

Integrations | High | Medium | Low | Low |

Offline facility | High | Medium | Low | Low |

Product maturity | High | High | Low | Low |

Support service | High | Medium | Low | Low |

Role-based access | Yes | Yes | NA | NA |

#of features | High | High | Low | Medium |

The comparative analysis looks like:

Bottom line:

Though EAM360 has weak points such as IBM Maximo mobile's popularity as an OEM product and pricing, it is strong in aspects such as:

- Robust offline functionality

- Strong integrations

- Role-based access

- Quicker implementation

Acquisition ability and core marketing pitch

Calculating TAM, SAM, SOB of EAM60

What is the Total Addressable Market of EAM360?

Before calculating the metrics for EAM360, it is important to calculate the metrics for the parent product - IBM Maximo.

IBM Maximo is an asset management and CMMS software that shares the market with:

- Large scale/ popular competitors such as SAP and Infor EAM

- Upcoming competitors such as FieldFlex, Upkeep, Fractal etc

Currently around 4000 customers around the globe use IBM Maximo for their enterprise. According to online data, IBM Maximo holds ~5% of the total market share.

Where does this put EAM360? This can be assessed by addressing the spending of each company on their IBM Maximo implementation.

Assuming the Average Order Value (AOV) of each company is ~$1Mn

Total count of all IBM Maximo users = 4000

Assuming around 1/3rd of the total share opt to adopt mobility for IBM Maximo -

Total market availability for all mobile apps (# prospects) = ~1350 prospects.

Holding the average order value of a mobile product at $700k , the Total Addressable Market =

Number of prospects * AOV

= 1350 * 700k

Total Addressable Market = $945Mn

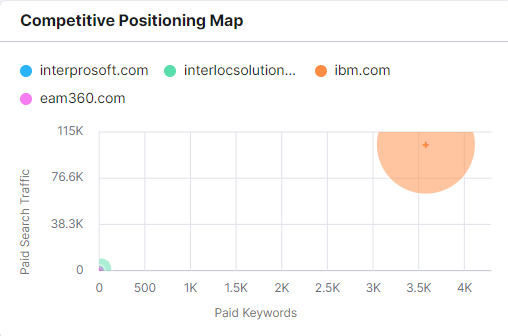

EAM360 shares market space with 3 other top competing products. There are smaller players such as Interpro etc who are able to capture anywhere between 5-10% of the market

Competitor product IBM Maximo mobile is able to capture around ~25% of the market due to being an OEM product.

Assuming EAM360, EZMax and A3J compete for the remaining 65% -

EAM360, as a mature product with 7+ years in the industry is able to capture 1/4th of that, which is around 16.5% as a Serviceable Addressable Market.

Holding the average order value of a mobile product at $700k, EAM360 has a TAM size = 16.5% of 1350 * $7000k

SAM = $156Mn

EAM360 as a product is currently able to capture about 15% of that with the existing set up, staffing and sales cycle to counter the competition.

This is calculated due to many prospects dropping off by rejecting mobility as a whole and jumping on to either competing products or remaining without holding a product from this category.

The Serviceable Obtainable Market for EAM360 would sit at around $23Mn.

This market is broad enough for EAM360 to continue scaling from its existing revenue + growth rates.

Core value proposition of EAM360

To all the ICP's and prospects that consider mobility as an option, here is a list of their pain points and JTBD's.

Persona | Pain points | JTBD | How EAM360 can help |

|---|---|---|---|

Ground technicians, crafters, storekeepers and supervisors who are direct users of the product. |

|

|

|

Asset managers, Engineering Manager, Plant Heads (ICP John's requirements) |

|

|

|

Assessing the pain points and JTBD's of users and decision makers, the core value proposition of EAM360 can be designed as follows:

Core product messaging | Boost field efficiency with offline mobility for your teams. |

Key outcomes | Efficient, faster, simpler, coherent, streamlined, seamless, structured. |

Top USP's | Offline, configurable, role-based, customizable, native, tech-powered, security, Maximo workflow, multi-language |

Larger messaging & selling statement | EAM360 is a simplified and central platform to manage enterprise asset information, handle Maximo workflows and execute work real-time. It is easy to use, comes customized to your role and can be configured down to your individual needs. Use the app anytime, anywhere—while you’re working connectionless on field, handling inventory in a storehouse or managing staff and performing approvals. Users of both iOS and Android mobiles can download the app to their phones, capture and act on data, integrate with their smart gadgets and use it with a range of tech tools and devices. With EAM360, people refocus on work that adds value to business—not the stacks of paperwork and files at the back. |

Acquisition channels for EAM360 - a mature product of 7+ years

As a product with more than 7 years active in the market and 1000+ user base, EAM360 is a mature product with extensive features, capabilities and functions.

It is also a product that is extensively integrated with both hardware devices as well as technology tools - with integrations spanning from Zebra scanners, Trimble devices, Beacons to software such as Autodesk, Sharepoint, ChatGPT, weather apps and more.

What are the top 2 acquisition channels that have been working well for EAM360?

- Paid advertising

- Organic results

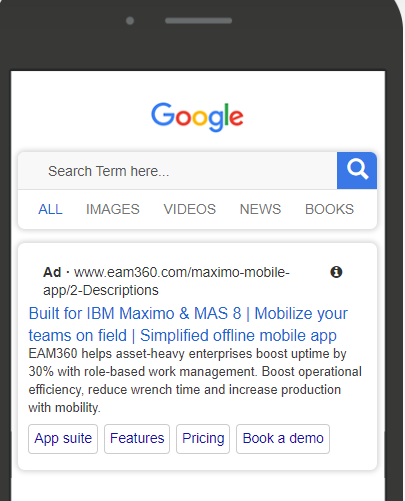

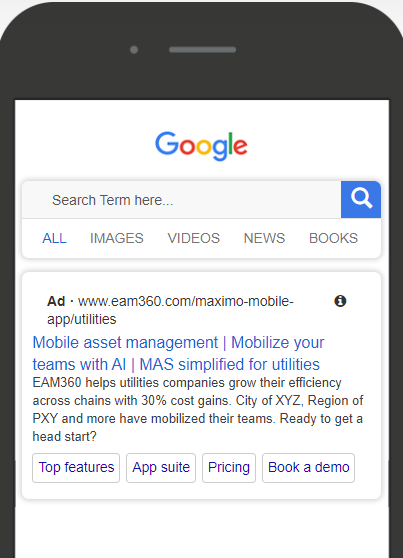

Channel 1: Acquisition through paid advertising

Paid advertising is an acquisition channel that works effectively in bringing in new accounts.

Being an enterprise mobile app, EAM360's CAC is negligible compared to LTV, and therefore does not need any major retrospection.

The top 3 paid advertising channels EAM360 leverages are:

- Google ads

- Email campaigns

- LinkedIn ads

Channel name | Cost | Fexibility | Effort | Speed | Scale | Budget |

Google search | $2000 | High | High | Medium | High | $2500-$3000 |

Linkedin ads | $1000 | High | Medium | Medium | Medium | $1000 |

Email campaign | $1000 | Low | High | High | Medium | $700-$1200 |

Total | $4000 | | | $5500 |

The current google ads are running across NA, ME and SEA regions to boost acquisitions, some of the top statistics for a single campaign targeting Maximo users.

Paid search on website is the:

1. 3rd largest source by volume

2. Accounts for 9% of total website traffic

3. Has the highest engagement time per session across channels

4. Has an engagement rate of 46%

The challenge

However, one major improvement that paid ads could see is the improvement in converting high-quality leads with shorter sales cycles.

The current paid ads are positioned to target DGM / GM's of Maximo practices and below in the organization hierarchy. Whilst they are also a part of the decision making committee, changing the structure, messaging and target keywords to address the search terms and requirements of senior management folks will eliminate intermediate communication channels, shorten lead time and help with better buy in.

Some reasons why paid ad leads have longer sales cycles:

- Blockage from senior management due to unfamiliarity with mobile solutions

- Hesitancy about the product from ground users that may later impact user adoption.

The solution

Considering an ICP of "John" - a Head Maximo Solutions Architect at a mid-sized utilities company in North America.

Some user behaviour of John:

- John is actively involved in collaborating with the Maximo SME's, Engineering Heads, Maintenance Leads and Operations Heads in his enterprise.

- John is one of the key stakeholders in ensuring streamlined O&M processes, and is responsible for overall boost in asset performance and throughput.

John spends the maximum amount of time on Google (search, maximo forums and news outlets) via his desktop, looking for additional information about best practices in asset management as a whole, understanding new regulations that come in and exploring specific IBM Maximo solutions that his team can adopt.

Running Google ad campaigns, where John is most likely to be looking for information on:

- Latest trends on asset management in his industries, ex: "utilities EAM trends 2024"

- Any Maximo-related queries to understand information from his Maximo teams., ex: "MAS updates" "Maximo upgrade services"

- Solutions to specific organization issues such as "operational efficiency overhead mitigation"

- General blogs, articles and information from peers.

Competitor analysis on related keywords:

Top paid keywords used by competitors include:

- mobile maximo

- maximo mobile for eam

- Utilities maximo app

- Utilities maximo eam

Links to view ads:

https://nordicclick.com/resources/google-ads-preview-tool?id=Jv0VqoZFVe4q

https://nordicclick.com/resources/google-ads-preview-tool?id=PgQgD3ks0PmU

Details of a prospective google ads program that we can run for a period between July 2024 to Nov 2024 months initially:

Google ads field | Input |

|---|---|

Setting Objective | Leads |

Campaign type | Search ads |

Campaign name | EAM360 Maximo mobile lead gen |

Ads schedule | Start date: 01/07/2024 |

Locations | United States and Canada |

Daily budget | With a monthly budget of $1500, |

Bidding strategy | Automated bid strategy to maximize conversions |

Keywords | utilities maximo app, mobile asset management, mobile maximo, maximo app, utilities mobile eam |

Match type | Phrase match |

By focussing on creating focussed page structure for each ICP, the chances of high-quality conversions are bound to increase.

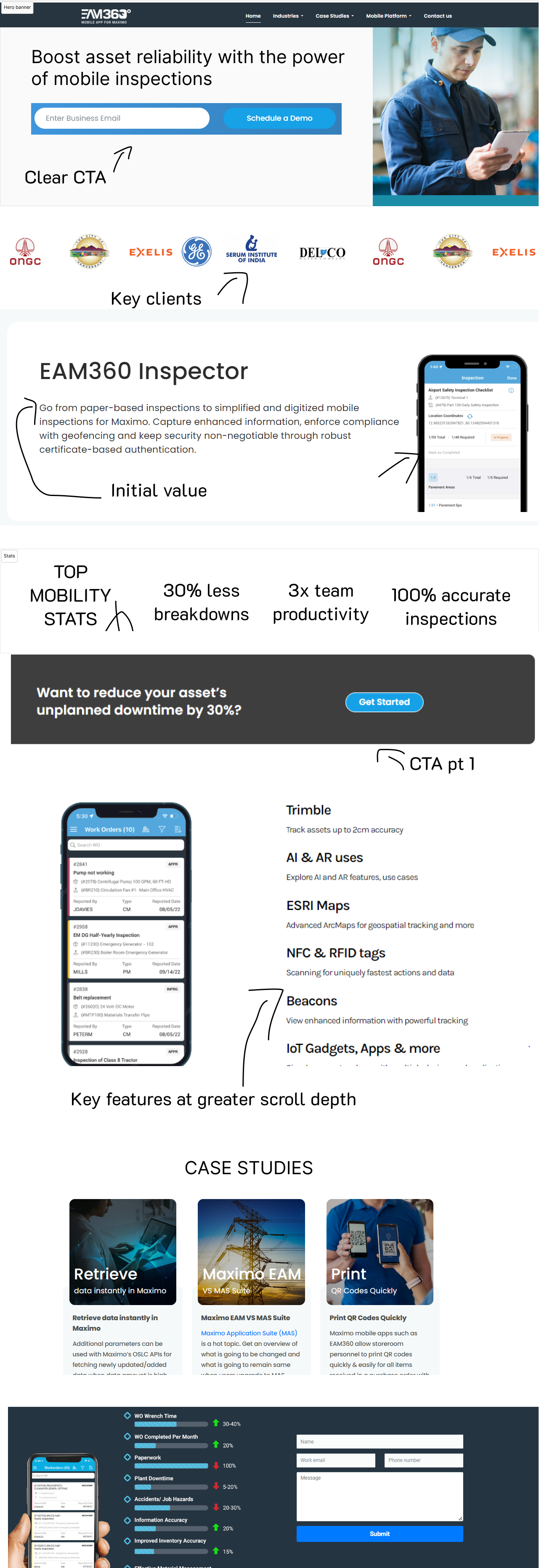

Channel 2: Acquisition through organic search

Organic search traffic for EAM360 is the top channel for website visitors.

Highlights on organic search:

1. Covers nearly >50% of all website visits and stands at #1

2. Most relevant keywords are at SERP 1-10

3. Has a 57% engagement rate

What key problem needs solving here?

Though we rank very high for relevant organic keywords with the right intent, we have a very small average engagement time of 53s with the majority of the traffic directed purely at the home page.

Navigating to the product page is also limited, with more traffic directed to blogs and quick exit times when product pages are visited.

Goal: We need to capture traffic with the right search intent and increase the retention on the product page subsequently.

The solution

The main focus of organic search here is to find out the exact search intent users are looking for when it comes to primary keywords, understand if we are optimized for said keywords and create high-quality content on product pages to help them rank for relevant interest. We will also do competitive analysis to determine how the main competitors are capturing audience interest.

Taking our primary keyword "maximo mobile", what are the related keywords, intent and difficulty to rank?

Note: This table also shows personalized keyword difficulty for EAM360's website.

The personalized Keyword Difficulty is 0 for top 4 keywords of highest relevance - this means that EAM360's website is already well optimized with high spots in the SERP and has high topical authority.

Two of those keywords are also Transactional in intent, which is a positive signal for the overall website.

Gap analysis with competitor

Results of competitive analysis to extract top competitors organically in the Maximo mobility space.

IBM is the main competitor in this space. A gap analysis would show keywords that do not exist in EAM360's website, along with the difficulty, search intent and and CPC.

Keyword | eam360.com | Search Volume | Keyword Difficulty | CPC | Competition | Results | Keyword Intents | eam360.com (pages) | www.ibm.com/products/maximo (pages) | | ||

|---|---|---|---|---|---|---|---|---|---|---|---|---|

mobile solution | 0 | 34 | 720 | 43 | 5.34 | 0.02 | 2.6E+09 | navigational | ||||

mobile inspection | 0 | 47 | 320 | 28 | 2.35 | 0.08 | 4.2E+08 | commercial, navigational | ||||

mobile vision | 0 | 52 | 210 | 25 | 1.03 | 0.25 | 1.6E+09 | commercial | ||||

mobile inspections | 0 | 43 | 90 | 30 | 2.35 | 0.08 | 6E+07 | commercial | ||||

mobile ai | 0 | 57 | 50 | 44 | 1.62 | 0.28 | 4.1E+09 | commercial | ||||

mobile asset solutions | 0 | 66 | 50 | 24 | 7.05 | 0.04 | 3.1E+08 | navigational | ||||

boost mobile maintenance | 0 | 40 | 30 | 21 | 1.78 | 0.13 | 3E+08 | commercial | ||||

ibm mobile | 0 | 2 | 20 | 50 | 9.79 | 0.14 | 1.3E+08 | navigational, transactional | ||||

service suite mobile application | 0 | 16 | 20 | 6 | 4.14 | 0.19 | 1.2E+09 | commercial |

Overall, this is an analysis of 3 main metrics that are needed:

- Top keywords and intent that we need to rank for organically

- Topics and keywords we are already ranking for

- How competitors acquire the traffic and capture intent we do not have

Collating our inferences:

Type of search | Keyword | Search volume (avg monthly) | Difficulty to rank on seo | Avg cost per click | Projected Click through rate | Cost per website/app land | Website land to conversion rate |

Use case | maximo mobile for eam | 45 | 29 | 0.00 | 3.45% | NA | 6.45% |

Competitor | IBM Maximo mobile app | 55 | 0 | $5.41 | 4.68% | NA | 7.25% |

Your product | maximo mobile app | 50 | 0 | $5.19 | 4.57% | NA | 5.65% |

Your brand name | EAM360 | 20 | 0 | 0 | 3.3% | NA | 4.45% |

The task at hand is to create high-authority, SEO optimized product pages and blogs that will help the retention rate and increase conversions.

Some major keywords we do not rank for with very high intent include:

- Mobile solution - too vague and high KD

- Mobile inspection

- Mobile asset solutions

- Boost mobile maintenance

Interestingly, this also connects with the original problem with paid ads - targeting higher-quality prospects with better decision making authority and intent.

A standard landing page would look like this:

In the blogs section, to increase authoritative content, some sample blogs can be:

- What are mobile inspections?

Intent: Informational

Primary keyword: "mobile inspections"

Secondary keywords: "asset inspections", "asset management", "maintenance management".

Article size: 1000 words - How to use maximo mobile for inspections?

Intent: Informational

Primary keyword: "maximo mobile inspection"

Secondary keywords: "ibm maximo", "inspection management", "asset inspection".

Article size: 1000-1500 words - Top 5 utilities asset management tech trends in 2024

Intent: Informational

Primary keyword: "utilities asset management"

Secondary keywords: "enterprise asset management", "utility management", "AI for utilities".

Article size: 750-1000 words - Top 5 mobile inspection apps for IBM Maximo

Intent: Transactional

Primary keyword: "Maximo mobile inspection"

Secondary keywords: "IBM Maximo","inspection management", "EZMax mobile", "asset management".

Article size: 1000-1500 words - Which mobile maintenance app is right for you?

Intent: Commercial

Primary keyword: "Maintenance management"

Secondary keywords: "IBM Maximo","maintenance and operations", "EZMax mobile", "O&M".

Article size: 1000-1500 words - What is asset performance management?

Intent: Informational

Primary keyword: "asset performance management"

Secondary keywords: "APM", "asset throughput", "infrastructure management".

Article size: 750-1000 words

By working through such info buckets and keyword research, it is possible to build a robust organic strategy that will pull up EAM360's rankings for various relevant topics.

Summary - acquisition for EAM360

As one of the top-performing products within its heavy niche, EAM360 has blown into mature stage over the past years. It has diversified its target audiences and created extensive features for each target segment specifically.

With greater focus on its top 3 acquisition channels via more targeted positioning, EAM360 can mitigate longer sales cycles, bring about change management and sustain against larger OEM products.

Brand focused courses

Great brands aren't built on clicks. They're built on trust. Craft narratives that resonate, campaigns that stand out, and brands that last.

All courses

Master every lever of growth — from acquisition to retention, data to events. Pick a course, go deep, and apply it to your business right away.

Explore courses by GrowthX

Built by Leaders From Amazon, CRED, Zepto, Hindustan Unilever, Flipkart, paytm & more

Course

Advanced Growth Strategy

Core principles to distribution, user onboarding, retention & monetisation.

58 modules

21 hours

Course

Go to Market

Learn to implement lean, balanced & all out GTM strategies while getting stakeholder buy-in.

17 modules

1 hour

Course

Brand Led Growth

Design your brand wedge & implement it across every customer touchpoint.

15 modules

2 hours

Course

Event Led Growth

Design an end to end strategy to create events that drive revenue growth.

48 modules

1 hour

Course

Growth Model Design

Learn how to break down your North Star metric into actionable input levers and prioritise them.

9 modules

1 hour

Course

Building Growth Teams

Learn how to design your team blueprint, attract, hire & retain great talent

24 modules

1 hour

Course

Data Led Growth

Learn the science of RCA & experimentation design to drive real revenue impact.

12 modules

2 hours

Course

Email marketing

Learn how to set up email as a channel and build the 0 → 1 strategy for email marketing

12 modules

1 hour

Course

Partnership Led Growth

Design product integrations & channel partnerships to drive revenue impact.

27 modules

1 hour

Course

Tech for Growth

Learn to ship better products with engineering & take informed trade-offs.

14 modules

2 hours

Crack a new job or a promotion with ELEVATE

Designed for mid-senior & leadership roles across growth, product, marketing, strategy & business

Learning Resources

Browse 500+ case studies, articles & resources the learning resources that you won't find on the internet.

Patience—you’re about to be impressed.